We bring you our regular Monday dose of summaries of the most interesting economic events that have had an impact on the currencies we trade in the past trading week!

EUR

ECB Executive Board member Fabio Panetta kicked off the week with an online seminar focused on inflation in the euro area.

Panetta mentioned that it would not be wise to commit to future policy actions in advance. The role of the ECB is clear: we will take all necessary measures and use all our tools to strengthen confidence and stabilise financial markets. This is the duty of a central bank in times of need.

Panetta's full speech can be found here:

https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220228~2ce9f09429.en.html

In the second half of the week, we saw new economic data regarding the Consumer Price Index (CPI) and the change in unemployment.

The year-on-year change in the euro area Consumer Price Index climbed to a current value of 5.8 %, compared with the previous value of 5.1 %. This implies a bullish signal for the euro.

Inflation in the eurozone is rising to new highs, and this only adds to the pressure on the ECB to deliver a firmer message at next week's meeting.

Thursday's data on the change in the unemployment rate was also favourable for the euro (current: 6.8 %, previous: 7.0 %). The unemployment rate is falling again and this only confirms the further improvement in labour market conditions.

On the same day, the ECB also issued its expected monetary policy statement, followed by a press conference.

The Governing Council expects the ECB's key interest rates to remain at current or lower levels until inflation reaches 2 %.

The full statement can be found here:

https://www.ecb.europa.eu/press/pr/date/2022/html/ecb.mp220203~90fbe94662.en.html

USD

The US dollar also had a relatively rich week for fundamentals.

At the beginning of the week, the latest Purchasing Managers' Index numbers came in, which were slightly more positive than expected (current: 58.6, previous: 57.6).

Chairman of the Federal Reserve - Jerome Powell mentioned in testimony before the House Financial Markets Committee on Thursday that The Fed must step back from highly stimulative monetary policy.

Rising mortgage rates are likely to start cooling demand for housing, and housing is a significant component of inflation. Powell also mentioned that the U.S. economy is very strong, but the labor market is extremely tight.

The speech suggests that the Fed could raise rates by 25 basis points, but would raise them by 50 basis points if necessary.

Record of the output:

The second half of the week brought a number of data regarding the change in the US Purchasing Managers' Index (PMI), which came out positive for the USD:

- Markit Composite PMI: current 55.9/previous 51.1

- Services PMI: current 56.5/previous 51.2

Faster production growth was supported by an increase in new sales. A solid increase in demand from foreign clients also contributed to total new orders.

Chris Williamson's chief business economist, IHS said service-sector companies reported a strong rebound in business activity during February as measures to contain the virus were eased to their weakest level since November. The data show that Omicron had only a modest and short-term impact on the economy.

On the other hand... The conflict in Ukraine, however, is leading to further upward movements in energy and broader commodity prices, which will further add to US inflationary pressures

The end of the week was also enriched by data from the US labour market. The unemployment rate fell by 3.8 % in February (previous 4 %), confirming the downward trend. However, the US labour market remains tight.

CAD

The Canadian dollar was the driver throughout last week, with interesting economic results coming in.

At the beginning of the week we were waiting for the result of the month-on-month GDP, which was a bit worse than expected (currently 0 %, previous: 0.6 %).

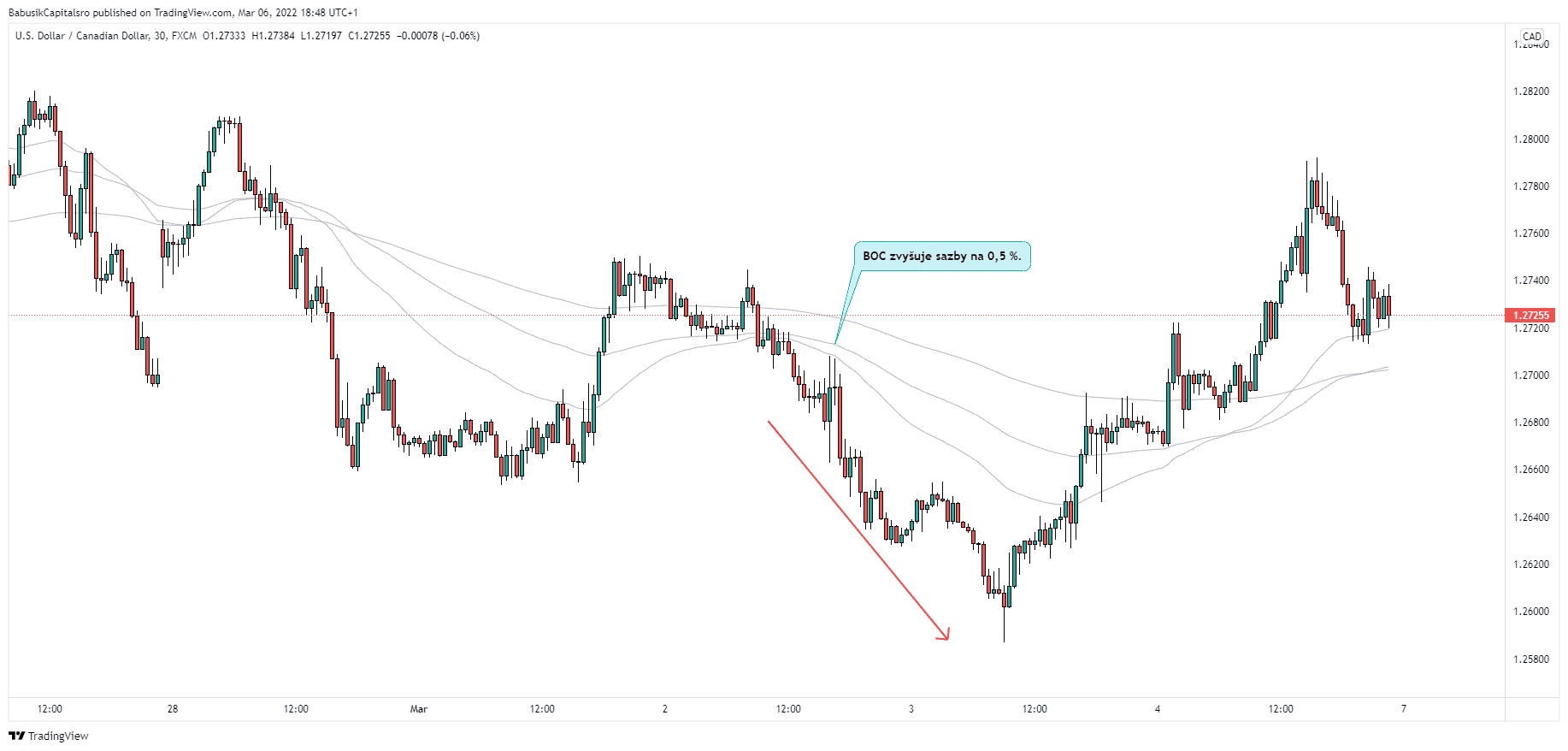

However, the markets were waiting for Wednesday's Bank of Canada (BOC) statement regarding the interest rate change.

Bank of Canada raised rates by 25 basis points to 0.50 %as expected and continues in the reinvestment phase. Furthermore, rates are expected to continue to rise at the next meetings!

As in other countries, Russia's invasion of Ukraine remains a major source of uncertainty. As a result, financial market volatility has increased.

BOC Governor - Tiff Macklem told the conference that Russia's invasion of Ukraine will cause further supply disruptions and the invasion will hit economic activity.

The full report can be found here:

https://www.bankofcanada.ca/2022/03/fad-press-release-2022-03-02/

Worldwide

Europe is still facing a war in Ukraine that has no end in sight. Neither are the negotiations to end this war.

As a result, many European currencies have become risky for the markets.

What's in store for the current trading week?

This week, the European Central Bank (ECB) will decide on a change in the interest rate, which has been at 0 % since 2016.

The ongoing war in Ukraine will be an integral part of the high volatility in the markets.

Keep an eye on our other reports to stay up to date!

Sources