The informal meeting of European leaders began on 10 March 2022 and will continue today (11 March 2022).

This time the meeting is held in Versailles and is attended by the heads of state and government of the European Union.

The topic of the meeting is Russia's military aggression against Ukraine and its consequences.

The EU leaders condemned the Russian military invasion of Ukraine, which constitutes a flagrant violation of international law and threatens European security, while praising the courage of the Ukrainian people in defending their homeland.

EU leaders continue to discuss how to strengthen European sovereignty and reduce dependence on Russia.

In this context, the following important topics are also discussed

The day before the EU leaders' meeting (9 March 2022), the EU Council adopted further measures, which are also directed at Belarus, which is participating in the invasion of Ukraine.

Measures taken include

More on EU reactions to the Russian invasion

https://www.consilium.europa.eu/cs/policies/eu-response-ukraine-invasion/

The European Central Bank left its current key rates unchanged at the meeting. Practically nothing else could be expected.

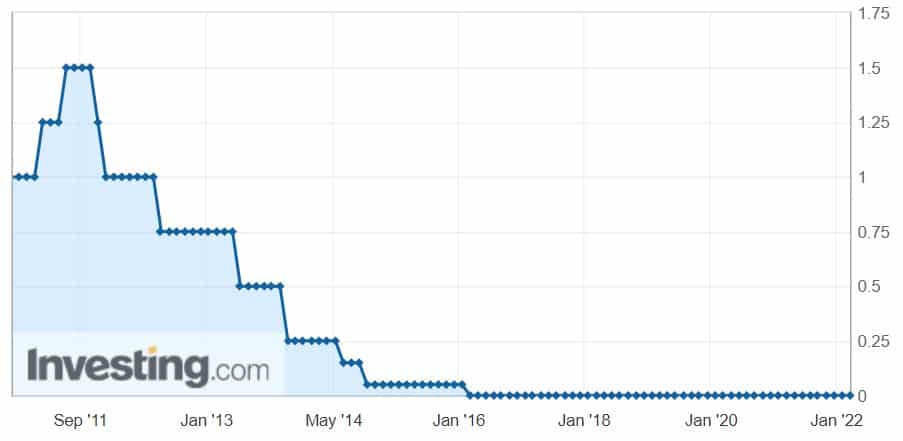

As we can see in the chart, the ECB has not raised rates since 2016 and they are currently still at zero.

However, the European Central Bank surprised the markets by trying to end the stimulus earlier than planned!

The statement said that the ECB would end its bond-buying programme in the third quarter if the economy allowed. But the ECB also added that it was prepared to reconsider that decision if the outlook changed.

A couple of minor changes accompany the announcement that the European Central Bank is slowly and surely moving away from the rhetoric that key rates could be lower than they currently are.

That's not surprising. No one would have expected a rate cut below 0 % to happen yet.

The surprise move comes amid growing fears that the eurozone economy could soon experience stagflation. Consumer prices in the 19 countries that use the euro have climbed to record highs for four consecutive months, most recently reaching 5.8 % in February.

President of the European Central Bank - Christine Lagarde mentioned at her press conference that an increase in key rates could come after the end of quantitative easing (QE).

The prospect of a rate hike is certainly good news for the bulls. However, Lagarde later warned that inflation could be much higher in the near future and the mood on the euro became rather bearish.

The euro is still under pressure after Wednesday's strengthening as all diplomatic efforts in the negotiations between Russia and Ukraine are almost fruitless.

Keep watching our newsto keep you in the loop!

Sources

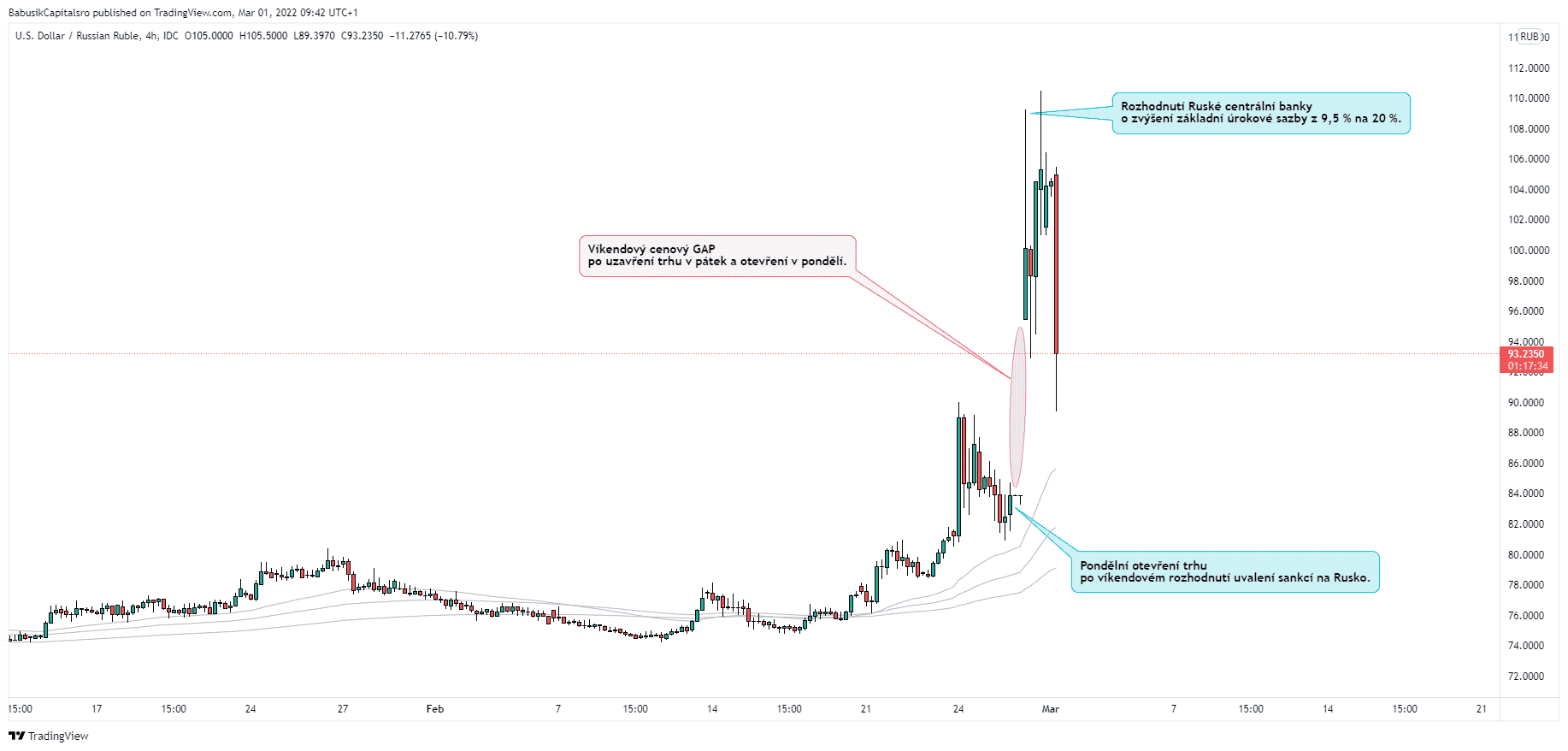

The Russian currency is currently experiencing a truly "devastating" period beyond memory.

The Russian ruble (RUB) was hit hard by the sanctions imposed on Russia by the West over the weekend.

The reason for the adoption of the toughest sanctions on Russia to date is the ongoing and escalating situation in Ukraine.

List of sanctions

In addition to the above-mentioned toughest sanctions, the US, the UK and the EU have adopted a number of smaller ones, such as the closure of EU airspace to Russian airlines.

Although the current sanctions will have a very negative economic impact on Russia, and denying access to the Russian Central Bank's foreign exchange reserves could bring about a total collapse of the ruble, the Russian people in particular will be significantly affected.

Russia sought to avoid a financial meltdown on Monday as Russian President Vladimir Putin held crisis talks with his top economic advisers after the ruble plunged to a record low against the US dollar.

The ruble fell by almost 30 % as a result of the weekend sanctions

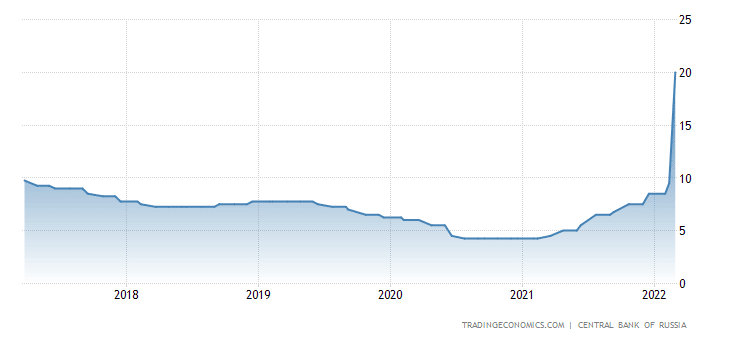

In response to the currency depreciation, the Russian central bank decided to raise the key rate to 20 % to avert the risks of ruble depreciation.

The increase in the base rate from 9.5 % to 20 % is the most in almost twenty years. According to the central bank, the rate hike is designed to offset the increased risk of ruble depreciation and inflation. Further, the central bank and the finance ministry have ordered companies to sell 80 % of their earnings in foreign currency.

Forex brokers have suspended ruble trading!

During the past week, many brokers suspended trading of currency pairs with the ruble. The reason was the escalating situation, due to which the liquidity of the Russian currency was falling sharply. This was alarming news for traders of "exotics" and the system close only (traders could only close positions held on currency pairs with the ruble) did not add much to the situation.

Of course, we are currently in very difficult times, which are not only having an impact on the currency markets. Especially on the European ones.

It will certainly depend on how far this conflict goes.

However, it is certain that the steps taken so far from all sides will have a big impact on the Russian economy.

Rising interest rates have made loans and mortgages more expensive, which will slow down investment.

The Russian central bank also announced that it will release 733 billion rubles from local banks' reserves by releasing the capital buffer created on unsecured consumer loans and mortgages.

Unfortunately, ordinary Russians will mainly feel inflation, which is reaching dizzying heights and threatens hyperinflation.

Thus, it cannot be said that the Russian currency has an optimistic future in the near future.

Do you want to keep up to date with what's happening in the markets?

Follow our regular summary of the most interesting economic events!

Sources