It's Monday and that means we're bringing you our regular recap of what affected the markets last week.

The first half of the week was a bit weaker on fundamentals, but that changed on Wednesday when we started to get interesting numbers from Japan and the eurozone.

Read on to keep up to date!

JPY

The Bank of Japan (BOJ) left interest rates unchanged on Wednesday, as expected.

The Japanese currency has gone through a rough patch over the past 2 months, weakening significantly against other currencies.

The BOJ very confidently reiterated that it would keep monetary policy loose. They will not be tightening anytime soon. The bank says it is committed to achieving its 2% inflation target and will keep policy loose. However, there were concerns that the bank would falter precisely because of the political pressure of a falling yen.

BOJ Governor Haruhiko Kuroda said at his press conference that it is desirable for the currency to move steadily in line with economic fundamentals and that the current strong monetary easing needs to continue.

The Japanese Finance Minister believes that the current high volatility in the Japanese currency is undesirable and will take appropriate action if necessary.

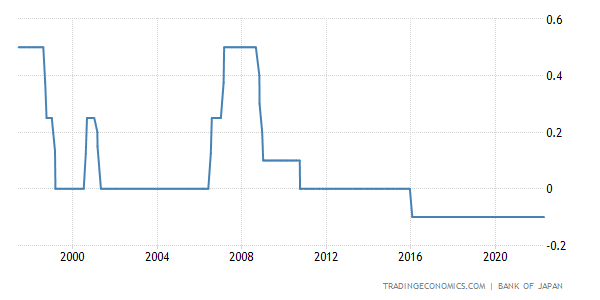

Frankly, we are very curious how the BOJ will deal with this situation. The central bank hasn't raised rates since 2016 and so they remain in negative territory at -0.10 %. There is also some speculation in the markets about a JPY FX intervention. Central banks usually resort to intervention when conventional stimulus processes do not work to get the economy moving.

Our view is that the BOJ is very conservative in terms of moving rates. The JPY is considered a so-called safe haven in times of crisis due to the BOJ's monetary policy. Which we also saw at the beginning of the Russian invasion of Ukraine. We think that excessive rate hikes to boost the economy would slightly damage this prestige of the JPY.

USD

On Wednesday, we could also see the actual quarterly GDP numbers in the US, which were not very good (current: - 1.4 % / previous: 6.9 %).

EUR

The euro area also brought interesting data at the end of the week:

- CPI (annual) - current: 7.5 % / previous: 7.4 %

- CPI (monthly) - current: 0.6 % / previous: 2.4 %

- GDP (quarterly) - current: 0.2 % / previous: 0.3 %

Headline annual inflation may have matched estimates as it crept to a new record high, but the more worrying figure is that core inflation jumped above estimates in April.

This will continue to make the ECB very uncomfortable. So far, there are still little signs that inflation has cooled significantly.

Euro area growth was slightly slower than expected in Q1 as the Russia-Ukraine conflict weighed on activity since the end of February.

What's in store for the current trading week?

This week will be marked by central banks and their interest rates. On Tuesday, we will focus our attention mainly on the Australian currency, where rates are expected to rise to 0.25 %. Later on Tuesday evening, the Reserve Bank of New Zealand will release its Financial Stability Report, which will be accompanied by a press conference on Wednesday.

On Wednesday evening, we will also await the change in US interest rates, which are expected to rise by 50 basis points.

On Thursday, we will again see an interest rate decision from the UK. There is also the expectation of an increase here.

This week will definitely bring volatility to the markets, so be cautious and use SL. 😊

We wish you a successful start to the new week!

Sources