The regular Monday recap is out! Read it to keep up with what happened last week.

EUR

On Thursday, we turned our attention to the monetary policy meeting of the European Central Bank (ECB), which kept its key interest rate at 4.5 %. This is a record high level.

USD

On Thursday we also got some data from the US, which was rather negative for the USD. According to the preliminary estimate, the US economy (GDP) grew by 3.3 % in Q4.

NZD

On Tuesday night we got the New Zealand inflation data which resulted in the NZD strengthening. The core annual inflation rate fell from 5.6 % to 4.7 %.

JPY

The Bank of Japan met on Tuesday morning and left the rate unchanged at -0.10 %. In any case, the BoJ kept the door open for a possible policy change.

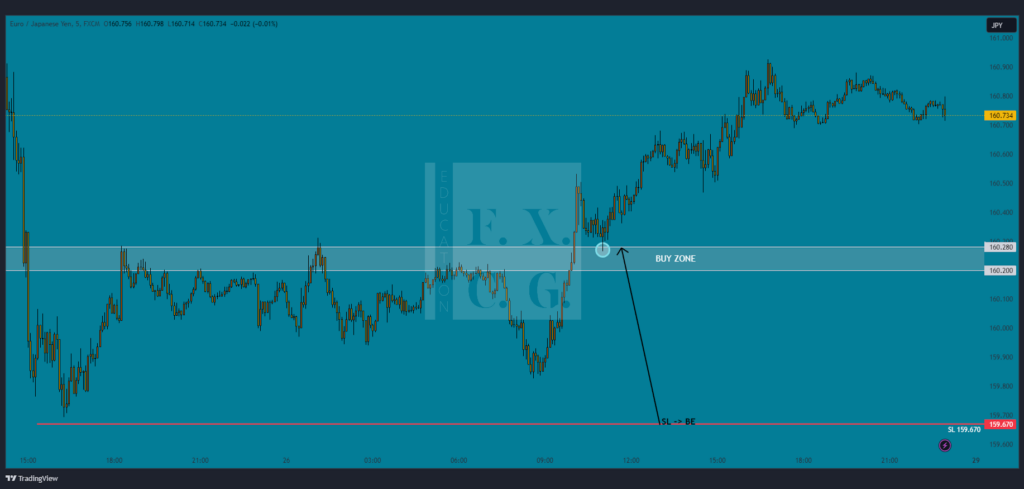

Analysis of EUR/JPY trade

The market calmed down after the ECB meeting and the price lost momentum still around our previous zone of interest. This morning's data on Tokyo inflation confirmed our continued outlook.

What's in store for the current trading week?

We start the week with Tuesday's data from the Japanese labour market, namely the unemployment rate, which is expected to remain unchanged (00:30). In the morning, we will also have preliminary data from Australian retail sales, which are estimated to fall (01:30). In the morning, we will focus on preliminary GDP in the euro area (11:00).