Welcome to our regular Monday recap of the most interesting economic events and results that affected our trading during the last trading week. Last week was one of the poorer weeks for economic results compared to previous weeks. Still, we have some interesting results worth noting.

EUR

Right on Monday (8.11.2021) we could see a statement by the US ECB economist, Philip Lane, who talked about inflation. According to him, the current period of inflation is very unusual but temporary. Inflation is quite high at the moment.

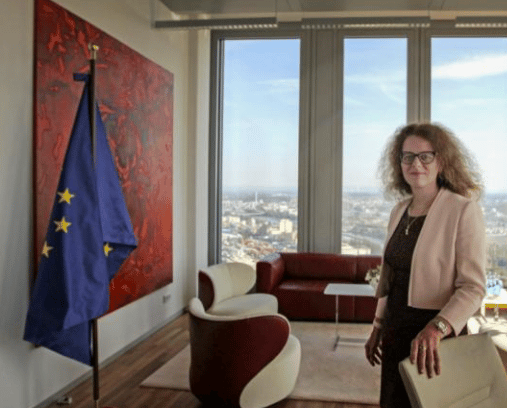

A day later, Isabel Schnabel, a member of the Executive Board of the European Central Bank (ECB), spoke, focusing more on EU house prices. Schnabel mentioned that monetary policy cannot turn a blind eye to credit growth in the institutional environment. House prices simply require more attention in terms of financial stability. There remains constant uncertainty about how sustained these price pressures will be...

USD

On Tuesday (9.11.2021), Fed chairman Jerome Powell spoke to us and mentioned almost nothing about the current outlook. The Fed is now paying more attention to the divergence in the labor market.

On this day, we could also see the monthly increase in the Product Price Index (PPI) from the previous 0.5 % to 0.6 %, which measures the change in the price of goods. This is one of the main indicators of inflation.

A higher value usually means a bullish bias for the USD.

On Wednesday (10.11.2021.), we watched the change in the US Consumer Price Index (CPI), which rose from the previous value of 0.2 % to 0.6 % in October. This higher value usually indicates a bullish scenario for the USD.

GBP

On Thursday (11.11.2021) we were interested in the month-on-month and year-on-year changes in UK GDP. Higher readings tend to be bullish for GBP. The year-on-year GDP value fell from 23.6 % to 6.6 %... The month-on-month change in the value was not drastic, of course, as its value only increased to 0.6 % from the previous 0.4 %.

What's in store for the current trading week?

In the current week, we will focus mainly on Tuesday and Thursday's retail sales in the US and the UK.

Sources:

Pictured here is Isabel Schnabel, Member of the Executive Board of the European Central Bank (ECB)