The start of a new trading week is here. That's why we have prepared another article in our regular series of summaries of economic events that affected our trading during the past week!

The first half of the week did not offer us much interesting data. However, this was corrected at the end of the week.

EUR

The week started with new figures concerning the current GDP development in the euro area.

The change in quarter-on-quarter and year-on-year GDP was almost as expected and quite positive for the euro:

- GDP (annual): current: 4.6 %, previous: 3.9 %

- GDP (quarter-on-quarter): current: 0.2 %, previous: 2.2 %

The euro area economy was growing moderately at the end of 2021. The world's current focus is still on the war in Ukraine, thus dictating sentiment for the euro.

The second half of the week brought the promised volatility to the euro, thanks to the informal meeting of EU leaders held on Thursday and Friday.

Also on Thursday, the European Central Bank left its current key policy rates unchanged at its monetary policy meeting. Rates have remained at zero since 2016.

Read also: Latest Euro developments - ECB and EU leaders meeting

USD

The US currency did not see any interesting data until Thursday.

First, the US CPI (Consumer Price Index) reports came out, which were positive for the US Dollar as expected.

- CPI (month-on-month): current: 0.5 %, previous: 0.6 %

- CPI (annual): current: 6.4 %, previous: 6 %

Later, the balance sheet of the US federal budget came out, which was not very optimistic...

The February US federal budget deficit was USD 217 billion, compared to the expected USD 49 billion.

It's not a number that will completely corner the markets, but at least we know where we stand. Anyway, when you add in the prospective costs that will fall on defense, energy, and inflation dampening, it at least makes a good case for another deeper deficit.

CAD

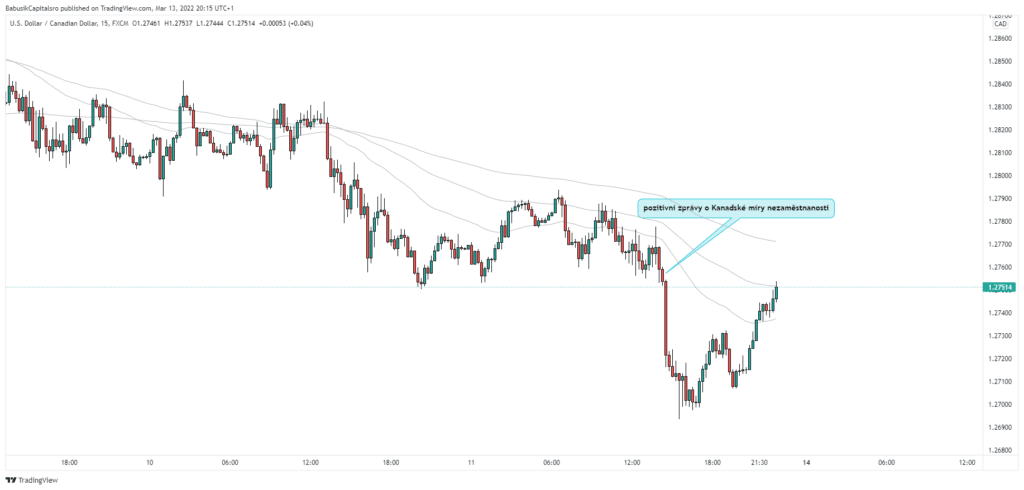

At the end of the week we could finally see some interesting data from the labour market in Canada.

The actual change in employment came out really positive (366.6 thousand actual vs. 160 thousand expected). This is the biggest jump since October 2020. Furthermore, the unemployment rate is expected to fall from 6.5 % to 6.2 %.

In January, the Canadian labour market recovery suffered a setback due to the Omicron option, with temporary layoffs in service industries and increased absenteeism. However, things now seem to be moving in the right direction.

Overall, the news was much better than expected, and a sharp rebound from the omicron. Expectations of a Bank of Canada (BOC) hike at the next meeting remain in favor of another 25 bps.

The positive news also helped the "Canadian", which started to strengthen against the dollar.

What's in store for the current trading week?

This week will have appropriate volatility. On Wednesday and Thursday, the markets will await the announcements regarding interest rate changes from the US and the UK. The Bank of Japan will then close the week with its interest rate statement.

Throughout the week, however, we will be watching incoming economic data from Canada regarding retail sales and the Eurozone Consumer Price Index.

Keep an eye on our regular issues to keep track!

Sources