Welcome to our regular recap of what happened over the past week.

AUD

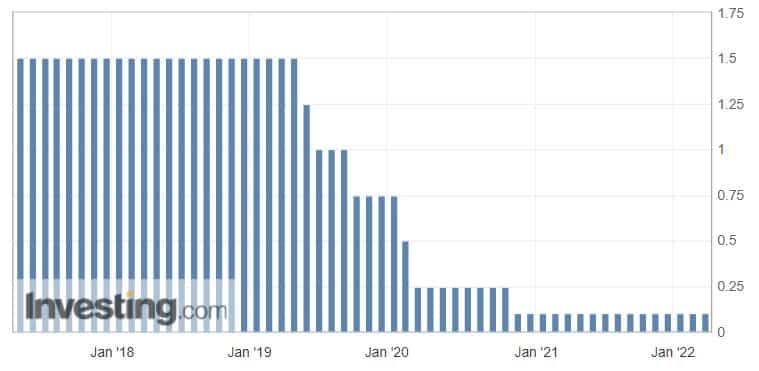

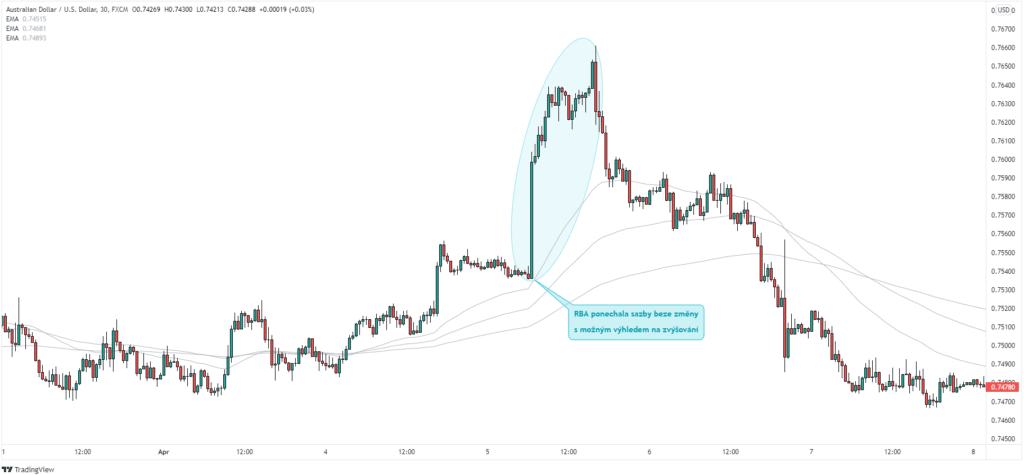

The Reserve Bank of Australia (RBA) earlier this week left the cash rate unchanged at 0.10 %, as also expected. Anyway, we could see minor changes in the RBA's rhetoric. The RBA is moving in a more aggressive direction and dropping the stance of being patient. This leads to assumptions that the RBA may in the near term raise rates. Before raising rates, however, the RBA wants to see that inflation is within the target range of 2 to 3 %.

The economy remains resilient and its strength is reflected in the labour market. Spending is starting to rise as wage growth has accelerated.

Keeping rates unchanged and a slight change in the RBA's rhetoric helped the Aussie currency to strengthen.

Read the full statement:

https://www.rba.gov.au/media-releases/2022/mr-22-11.html

EUR

Last week also brought interesting numbers on the euro. Earlier in the week we were able to see new data on the purchasing managers' indices (PMIs), which were almost unchanged as expected:

- Composite PMI (combined) - current: 54.9 / previous: 55.5

- Services PMI (services) - current: 55.6 / previous: 55.5

Looser restrictions under Covid helped to push services activity in the euro area to a four-month high.

In the second half of the week, we could expect new data from the labour market and the publication of the ECB monetary policy meeting report.

Retail sales improved slightly in February - actual: 0.3 % / previous 0.2 %

It is clear from the ECB minutes that a large number of members see that the current trend of rising inflation in the euro area urgently requires further action.

Full report:

https://www.ecb.europa.eu/press/accounts/2022/html/ecb.mg220406~8e7069ffa0.en.html

GBP

Last week also saw the release of the latest UK Purchasing Managers' Index (PMI) numbers, which were slightly more positive:

- Composite PMI (combined) - current: 60.9 /previous: 59.9

- Services PMI (services) - current: 62.6 / previous: 60.5

- Construction PMI (construction) - current: 59.1 / previous: 59.1

UK economic growth continued to accelerate in March, following the Omicron-induced slowdown at the turn of the year, and business activity grew at its fastest pace.

Construction activity also continues to grow strongly.

USD

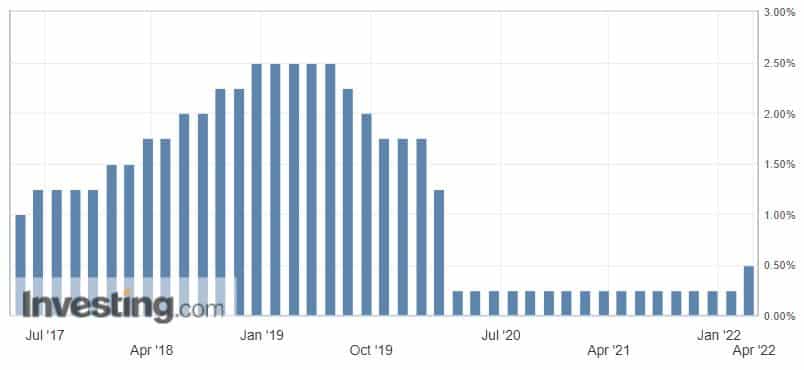

The main event of last week was the so-called FOMC minutes on Wednesday, which only concern the US dollar.

The minutes show that many participants are in favour of raising rates by another 50 basis points. The Fed had already raised rates by 25 basis points on 16 March.

This gives the US dollar bullish signals for the future.

Full entry:

https://www.federalreserve.gov/monetarypolicy/fomcminutes20220316.htm

CAD

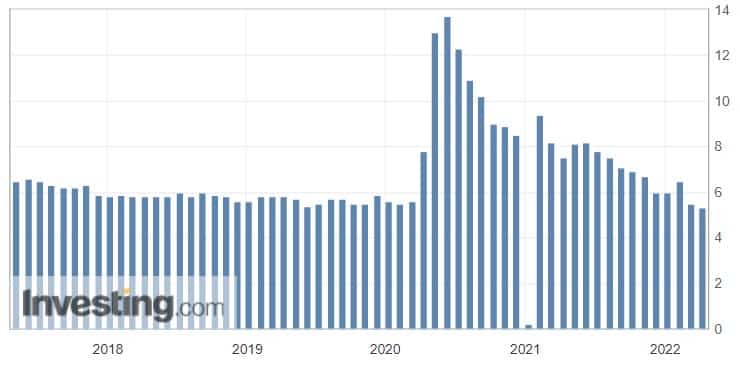

Last week, we received mainly new data from Canada concerning the labour market.

The new results show us that Canada's unemployment rate is steadily declining, and that's a good thing.

Unemployment rate - current: 5.3 % / previous: 5.5 %

What's in store for the current trading week?

The current trading week will be mainly marked by interest rate decisions coming out of New Zealand, Canada and the Eurozone. During the week we will also get a number of data regarding consumer price change (CPI) from the UK and the US. There will also be new data from the Australian labour market later in the week.

Keep an eye on our regular issues to keep track!

Sources