We bring you the regular Monday summary of economic events we followed in the last trading week, which was rich in statistical data.

Read on to stay in the loop!

USD

The US currency has had a really rich week in terms of economic events. On Wednesday we could observe the growth of the US quarterly GDP, which was considerable (current: 6.9 %, previous: 2.3 %).

On the same day, the latest figures were released, which concerned the March ADP unemployment rate in the USA (current: 455 thousand). The ADP National Employment Report is a measure of monthly changes in nonfarm private employment.

The market is satisfied with the jobs situation at the moment. There is evidence that the Fed has changed its rhetoric to say that a hike to get inflation under control will be good for the long-term health of the labor market.

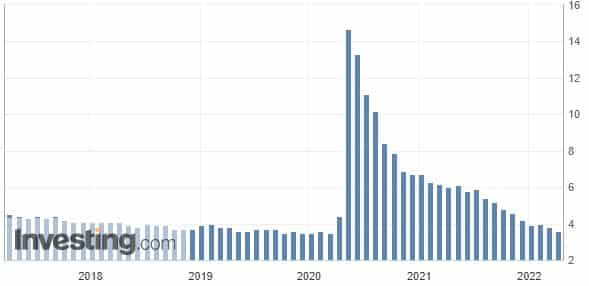

The end of the week brought us data concerning the so-called US NFP (nonfarm payrolls). These measure the change in the number of people employed during the previous month, excluding agriculture. Job creation is the main indicator of consumer spending, which makes up the bulk of economic activity.

The labour market remains strong and wage growth continues.

- US Nonfarm Payrolls - current: 431 thous.

Friday's US unemployment rate showed us again that the labour market is starting to recover and strengthen (current: 3.6 %, previous: 3.8 %).

The US President's comments - J. Biden confirmed the situation when he said that more American workers now have real power to get better wages.

EUR

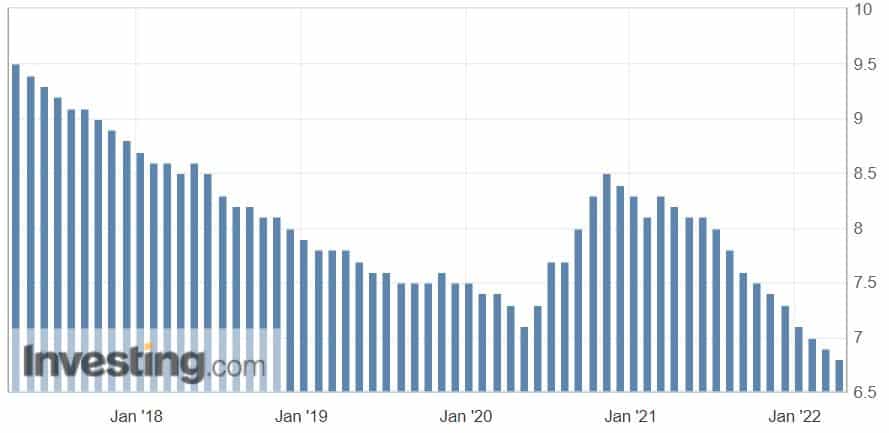

Wednesday's news from the Eurozone showed us that the unemployment rate in the Eurozone is on a downward trend (current: 6.8 %, previous: 6.9 %). The unemployment rate is thus at a record low. This is due to more favourable labour market conditions, which continue to underline the recovery from the pandemic.

GBP

The British pound had an interesting week in terms of economic news. In the second half of the week, the UK GDP news came out:

- quarterly GDP - current: 1.3 %, previous: 0.9 %

- annual GDP - current: 6.6 %, previous: 6.9 %

Late in the week, data was released regarding the Purchasing Managers' Index (PMI), which generally gives us a current view of the health of the economy (current: 55.2, previous: 58).

UK manufacturing growth slowed to a 13-month low as output and new orders grew at a reduced pace, while new export business fell for a second month. Inflationary pressures also affected overall activity.

AUD

The Australian currency has had a somewhat quiet week. At least as far as economic data is concerned.

At the beginning of the week we could only see new data concerning Australian retail sales. It turned out only slightly more positive (actual: 1.8 %, previous: 1.6 %) and thus was not particularly bullish for the Australian currency.

CAD

Similar to the Australian currency (AUD), the Canadian dollar (CAD) had a quieter week.

On Thursday (31 March) we could see the results of the monthly GDP, which increased only slightly (current: 0.2 %, previous: 0.1 %).

What's in store for the current trading week?

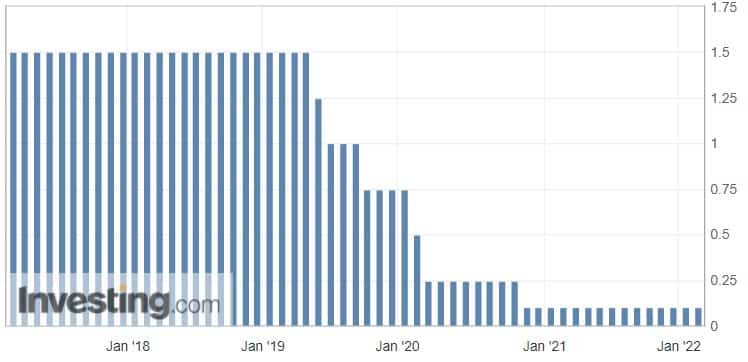

This week we will focus mainly on the Reserve Bank of Australia, which will decide on Tuesday on the interest rate change. Expectations for a hike are not very high. The RBA is leaving rates at 0.10 % from November 2020.

The second half of the week will offer us some economic data, mainly related to unemployment in Canada and retail sales in the Eurozone.

Keep an eye on our regular issues to keep track!

Sources