Welcome to the first Fundamental Summary in March. Join us as we recap the most important events that impacted the markets at the turn of the month. Stay in the loop!

EUR

During the week, we received mostly inflation data from the euro area. France's annual inflation rate slowed to 2.9 % in February, the lowest since January 2022. Germany's inflation also posted a decline from 2.9 % to 2.5 in February, the lowest inflation rate since June 2021. Inflation also fell in Spain, where it slowed to 2.8 %.

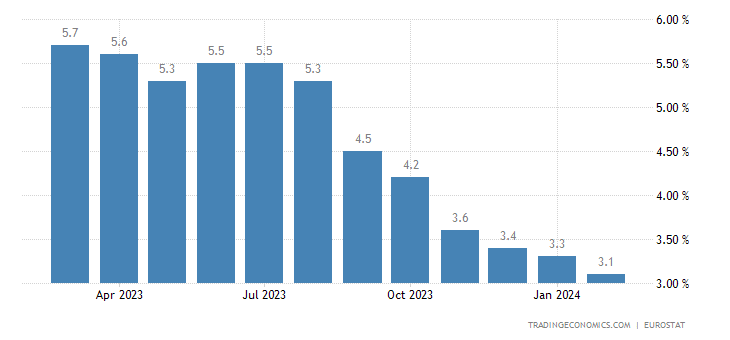

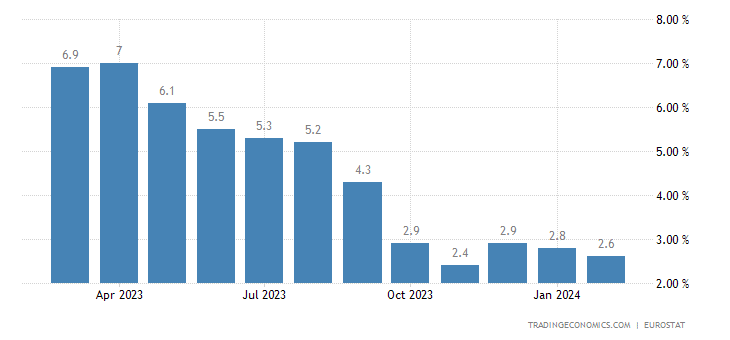

For the euro area as a whole, the annual core inflation rate fell to 3.1 %, slightly above market estimates but still the lowest since March 2022. The core inflation rate fell to 2.6 %.

Overall, the data are lower, and this is reassuring for the European Central Bank (ECB). Nothing should change in terms of the June rate cut. Negative for the euro.

At the end of the week, we focused on the unemployment rate, which, unlike inflation, was positive. The unemployment rate fell to 6.4 %, the lowest on record. This tells us that labour market conditions are holding up well. Positive for the euro.

What's in store for us this week?

Looks like we're in for quite a busy week. Monday's Swiss inflation rate should give us more clarity towards a March rate cut, where there is currently about a 50% chance.

Sources: