Welcome to our regular Monday recap of the most important economic events that affected the markets during the last trading week.

The start of last week was relatively modest for economic data. The second half of the week brought some interesting numbers, mostly from the euro area.

Read on to keep up to date!

NZD

The start of the week was kicked off by a statement from Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr, who mentioned that the current challenge for the RBNZ will be a "soft landing" over the next few years without a recession, where fiscal support will be needed.

AUD

On Tuesday morning, the Reserve Bank of Australia (BOA) released the minutes of its monetary policy meeting.

The meeting shows that we can expect another rate hike in June.

The Australian economy remains resilient and spending is growing. Wage growth has accelerated as well.

Members noted that higher petrol prices would lead to higher inflation in the coming quarters.

Financial conditions need to remain accommodating.

The full minutes can be found here:

https://www.rba.gov.au/monetary-policy/rba-board-minutes/2022/2022-04-05.html

CAD

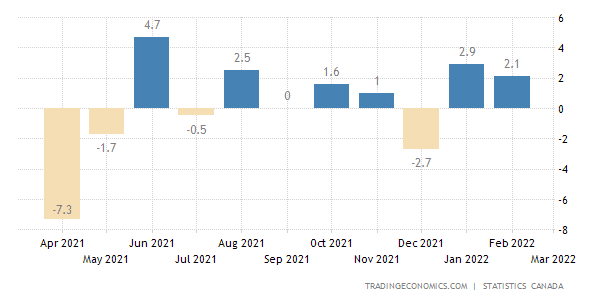

At the end of the week, we saw results from Canadian retail sales (excluding autos), which were slightly weaker than last month (current: 2.1 %, previous: 2.9 %).

The Canadian economy has reopened after the January and February quarantine. Signs of March growth are positive. What's worrisome is new vehicle sales, down 11 % compared to 2/2021.

EUR

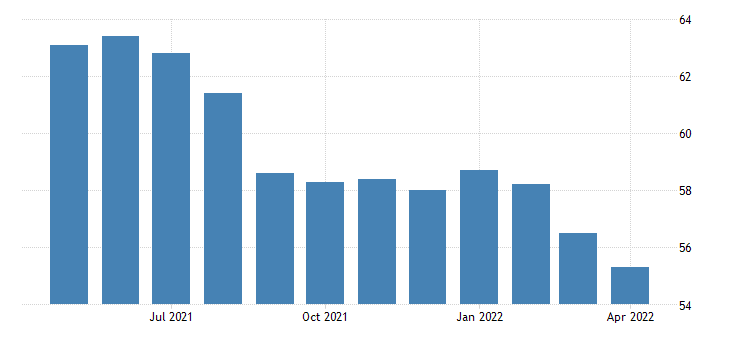

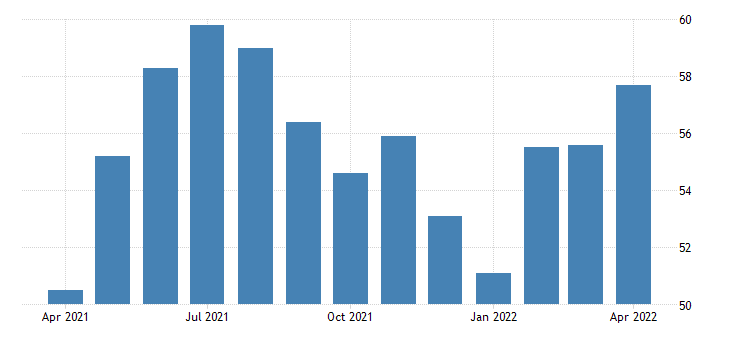

Last week also offered us some interesting Consumer Price Index (CPI) and Purchasing Managers' Index (PMI) numbers from the euro area.

- CPI (March) - current: 7.4 % / previous: 5.9 %

- PMI (manufacturing) - current: 55.3 / previous: 56.5

- PMI (services) - current: 57.7 / previous: 55.6

The details reveal that the surge in services comes as we see another reopening of the economy. Meanwhile, the downturn in manufacturing comes as supply chain disruptions continue to persist and we also see demand conditions cooling. The latter in particular is not an entirely positive sign.

Taking into account concerns about production conditions, weighed down by the Russia-Ukraine conflict and quarantine measures in China, this could lead to another challenging month despite these better figures.

What's in store for the current trading week?

The first half of this week will be rather modest for economic data. We will focus our attention on Thursday's Bank of Japan (BOJ) meeting, which will decide on the current interest rate settings. Later in the day, the latest US GDP numbers will be of interest.

We wish you a successful start to the new week!

Sources